How Do I Know If A Loan Company Is Legit?

Knowing if a loan company is legit can sometimes be tricky as fraudsters are engineering different techniques to defraud people.

A lot of people ask this question “How do I know if a loan company is legit?”. With the rapid increase of fraudulent activities taking place on the internet which most of them remain unchecked. As a result of this fraud being perpetrated by criminals, people are beginning to lose confidence in legit loans companies that are genuinely giving out loans.

With different fintech companies emerging every day, a lot of money lending companies are coming up and most of them usually offer loans without collateral.

How to know a fake or legit loan company

Fraudsters have now come up with new methods of siphoning money from innocent people using dubious means such as the cloning of websites.

In this article, I’ll show you the things you need to spot out in other to know if a loan company is legit or a scam.

Also Read: Paylater Loan

So the question now is;

How Do I Know If A Loan Company Is Legit?

For you to know if a loan company is legit, here are the major things you need to look out for;

- Website asking for an Upfront Processing Fee?

- Website is not having an SSL Certificate or the correct URL?

- The company is not registered with CAC or IRS

- Company has no Online Presence

- The lender has no Verifiable Address

- Loan company showing no interest on your credit score

- The company is not transparent about its fees

- Are they asking for an upfront processing fee?

Loan companies have the sole responsibility to loan you money, that is one of the reasons you are using their platform. But in a scenario when you are asked to pay some upfront fee before they grant you a loan, then there is every possibility of that company being a scam.

We have seen cases where loan companies, apps or websites ask people to pay an upfront fee before their loans will be disbursed.

Here is how this fraudster makes their money. when you sign up on their platform (website or App), they will offer you a huge amount of loan, something you cannot resist.

when it gets to the stage where you will receive your money, they will now ask you to pay a little fee before they can process your loan.

For example, you can be offered something like 2000$ to pay a 20$ disbursement fee. Because of how desperate you are, you might likely go ahead and pay the $20 upfront fee.

Once you pay the disbursement fee, they have successfully scammed you. Try as much as possible to stay away from such companies.

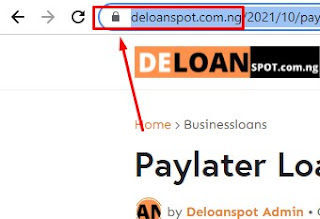

Check If Website Is Using an SSL Security Or The Correct URL

An SSL security is website encryption that ensures hackers don’t steal sensitive information from you. If a website is not having SSL security, it is with no doubt that the website is there to steal your credit card information or any sensitive details about you. So try to avoid such a website!

To confirm if a website is having an SSL certificate see the image below;

Most fraudsters who likely use such scamming methods are probably hackers with knowledge of web development and phishing.

When they find a company that is offering loans, they will go ahead and create a clone of that website or app.

For example, if a website is www.loanoffer.com, they will go ahead and create their own version with a domain name like www.lcanoffer.com. sometimes as a result of haste, you might not be able to spot the difference.

Once you perform any transaction on the website, they can automatically steal your information or credit card details which they will go ahead and use on the real website to impersonate you.

Also Read: Getting a loan without collateral

The company is not registered with CAC or IRS

If you’re living in a place like Nigeria, you’ll be familiar with the word CAC. CAC simply stands for cooperate affairs commission. It is a body responsible for the registration and reservation of businesses in the country.

The same applies in places like the United state where IRS is responsible for tax return processing, taxpayer service, and enforcement. The IRS also conducts criminal investigations and oversees tax-exempt organizations and qualified retirement plans.

The CAC and IRS have the sole responsibility of ensuring that every business being registered are not in the market to defraud people. As a result of the strict measures associated with business registration and reservation. Most fraudsters will likely not register their business as lenders with the government.

Before you embark on applying for a loan with a business you’re sceptical about, make sure you confirm the legitimacy and the authenticity of that business on the CAC or any government body responsible for business registration in your country.

Looking up a business all varies from country to country. Make you confirm the body responsible for business registration in your country.

Once you can not find the lending company as a registered business try as much as possible to avoid such a website or company. They are scammers!

Company Has No Online Presence

No matter how new a company might be, there should be an online presence about that company. As a fintech or new lending company, there should be written content about the business by popular news websites or tech websites with reputable authority such as Tech Crunch or Tech Cabal.

If for some reason you can’t find any online presence showing that the company is legit, you can copy the URL of the website and do a proper look up on ICAN LOOKUP.

This lookup will reveal sensitive information about a company such as the age of the domain and the details of the registered owner.

This lookup helps in identifying websites that are created for the sole purpose of defrauding people. But in some cases, some websites are hidden from public lookup. When you notice that website information is hidden from ICAN lookup. kindly stay away from such kind of lending company.

Another great way of checking on businesses is using Trust Pilot or Better Business Bureau (BBB)

Lender With No Verifiable Address

Every business needs a physical address where people can visit to get access to the services being offered by the company. Some fake lenders can put up a fake or non-existing address on their website.

So, how will you know if the website or business address is true?

what you need to do is to use Google Maps to verify the address of the business. Google has been known to be a great source for verifying businesses.

If you are still not satisfied with the information you’re getting from Google Maps, you can go ahead and use google earth to confirm how the head office of the lending company looks like. With google earth you can see a real-time image of an address you searched for.

For any reason, if a lender address can not be verified, please stay away from such lending companies, they might be scammers.

Loan Company Has No Interest In Your Credit Score

When a company is not interested in knowing your credit score then there must be something fishy about such a company. It is the responsibility of a lender to check the credit score of its customers before giving out a loan.

In a country like Nigeria, lenders use what is known as Bank Verification Number (BVN) to evaluate their customer’s credit scores.

The BVN allows the lender to check everything regarding your financial status. For other countries, I believe they have their own way of verifying the credit score of customers.

When you notice that the loan company is not interested in knowing your credit score using BVN or any other verification means then know that they are in to scam you.

Company Is Not Transparent About Its Fees

Transparency is very important when it comes to the loan business. Every lender tries to make its fees and interest as transparent as possible. This is one of the ways they use in enlightening the public that they have better service than their competitors.

If for any reason, if a loan company is trying to play smart by not being clear about its fees and interest rate, then you should have a second thought about the kind of information you give out to such a company. They might likely be scammers!

Popular Scams By Fraudsters regarding Loan Offer

You Just Won a Loan

That sounds dumb, right?

But a scammer can think he is smart when he tells you that you have won a loan. Some of them are lucky to get victims who fall for their scam. people don’t win loans, they qualify for a loan and most loans should be granted based on request.

If for any reason you receive a call from anyone claiming to be a loan company or officer, try as much as possible to avoid such calls. They are scammers

Loan Company Asking You To Claim Loan with Gift Card

Gift card has been one of the most popular ways scammers use in siphoning money from their victim. They usually ask their victim to fund an Amazon gift card, Walmart gift card or any popular gift card before they can get a loan.

Please kindly note that no legitimate loan company will ask you to pay them with a gift card before they can disburse your loan.

Conclusion

If you find this post helpful, don’t forget to share it with people who might need to see it. For any question or experience regarding loan scams, you can drop it in the comment section. We’ll try to respond as soon as possible.

Thanks for reading